Ms. Lena lee

Leave a message

Ms. Lena lee

Leave a messageAmid the pandemic-era consumer boom, container shipping lines have reaped huge profits. From 2020 to 2022, different shipping companies have adopted different fleet strategies, ranging from actively expanding market share, to keeping capacity flat, or even reducing capacity. As the historic super cycle is gradually coming to an end, let`s take stock of the evolution of the shipping capacity of shipping companies in the past three years.

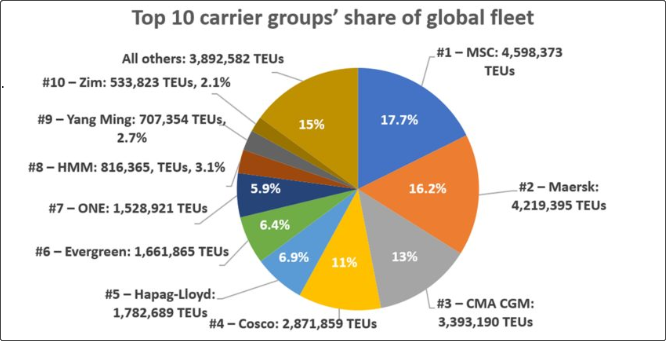

Alphaliner recently released an overview of fleet changes in 2022. Combined with its historical record data, the total market share of the top ten shipping companies has remained stable during the super cycle, currently accounting for 85% of the global fleet, compared to 84% in early 2020. %. However, the market shares of various shipping companies have changed greatly.

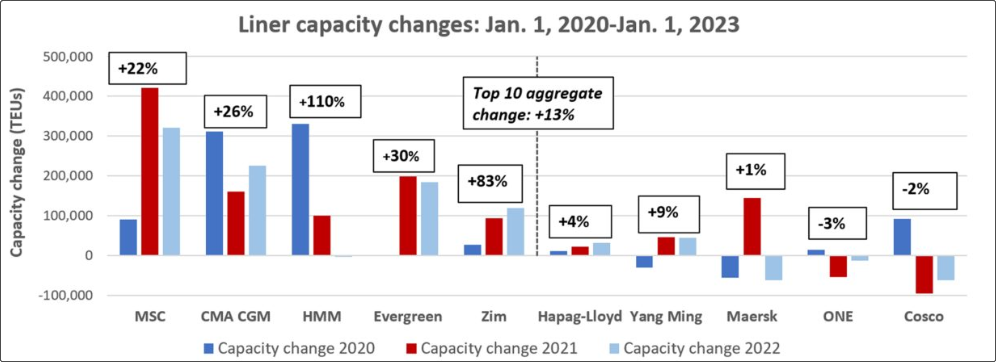

Alphaliner data shows that during the period from January 1, 2020 to January 1, 2023, the combined capacity of the top ten liner companies increased by 2.6 million TEU, an increase of 13%. Five shipping companies drove the gains.

Changes in capacity in dark blue in 2020; changes in capacity in red in 2021 and changes in light blue in 2022; percentages indicate changes in fleet capacity between January 1, 2023 and January 1, 2020 / data source: Alphaliner; chart source: American Shipper

• MSC: Since surpassing Maersk in January last year, MSC has become the world's largest shipping company, with the largest increase in absolute capacity. During the past three years, its capacity has increased by 832,000 TEU, an increase of 22%.

According to Alphaliner, in 2022, MSC's capacity will increase by 7.5%, mainly through the acquisition of second-hand ships; in 2021, through the acquisition of second-hand ships, ship leasing and delivery of newbuildings, the capacity will increase by 10.7%.

• CMA CGM: currently the world's third largest liner operator, ranked fourth before the epidemic.

The company's capacity growth is second only to MSC. Over the past three years, CMA CGM has increased its capacity by 697,000 TEUs, an increase of 26%. Part of this growth is due to new ships ordered before the super cycle and delivered in 2020-2021; in 2022, its capacity increased by 7.1%.

• HMM: The shipping company with the third highest capacity increase in 2020-2022 is HMM, with an increase of 428,000 TEUs, rising from the tenth in the world in January 2020 to the eighth now. The company has grown its capacity by 110% over the past three years, the highest increase among the top 10 carriers, albeit from a relatively small base.

However, the majority of this increase was made in 2020, as 12 new ships were delivered and nine ships were returned from charter cancellations, Alphaliner reported. HMM's capacity growth stalled in 2022, with capacity down 0.4% year-on-year.

•Evergreen Shipping: currently the sixth largest shipping company in the world (ranked seventh in 2020), its capacity increased by 30% during the super cycle, or 385,000 TEU. Almost all of the growth will occur in 2021-2022.

Alphaliner said that Evergreen will deliver no fewer than 20 new ships in 2022. In 2021, its capacity growth has also been driven by newbuildings, with 14 new ships coming into service.

Capacity and market share percentage of the top ten shipping companies/Data source: Alphaliner Top 100 on January 5, 2023; Chart source: American Shipper

• Zim: Some shipping lines increased capacity due to new vessels ordered before the pandemic, while others specifically boosted capacity to take advantage of the booming freight market. One of them is MSC, which mainly achieves growth by purchasing second-hand ships; the other is ZIM, the tenth largest shipping company in the world, which adopts a different capacity growth strategy: chartering ships.

According to Alphaliner's data, from January 1, 2020 to January 1, 2023, Zim's shipping capacity has increased by 242,000 TEU, an increase of 83%, which is the second fastest shipping company after HMM.

Last year, the company increased capacity by 29%, the highest increase among the top 10 companies in 2022. Alphaliner said Zim was particularly active in the charter market, as the end of its partnership with 2M on the Asia-Mediterranean and Asia-West trades meant it needed some additional capacity to remain competitive in those trade lanes .

The other five shipping lines in the top ten shipping lines have either experienced moderate capacity growth or declining capacity over the past three years.

• Hapag-Lloyd: Currently the fifth largest shipping company in the world, its shipping capacity will increase by 1.8% in 2022; its shipping capacity has increased by 64,800 TEUs in the past three years, an increase of 4%.

• Yangming Shipping: Currently the ninth largest shipping company in the world (ranked eighth in 2020), its shipping capacity has increased by 61,000 TEUs in the past three years, an increase of 9%.

•Maersk: The world's second largest shipping company, in the past three years, capacity has remained stable, an increase of 0.6%. Maersk was long the world's largest liner operator until it was overtaken by MSC a year ago. In 2022, the company`s capacity has fallen by 62,000 TEU, or 1.4%.

"Our strategy is not to gain market share in ocean shipping," former Maersk CEO Soren Skou said previously. "We no longer define ourselves by ocean freight capacity, our strategy is to capture share of our customers' logistics spend."

Alphaliner said: [The company had to hand over a large number of chartered vessels. These vessels were either sold second-hand or chartered to competitors who were willing to pay higher charter fees or accept longer charter terms."

• ONE: According to data from Alphaliner, ONE, the seventh largest shipping company in the world, reduced its shipping capacity by 0.8% last year. Since January 2020, the company has reduced capacity by 52,000 TEU, or 3%.

• COSCO: In the past three years, COSCO has seen the largest drop in capacity, with a reduction of 66,000 TEUs, a drop of 2%. It is currently the fourth largest liner operator in the world and will drop from third to fourth in 2021. Alphaliner said that the capacity of COSCO's fleet has declined for two consecutive years. After a decrease of 3.2% in 2021, it will fall by 2.1% in 2022.

Changes in shipping company capacity during the pandemic are only part of the story. The other part is new ship orders. Shipping companies took advantage of the huge profits gained from the consumption boom to order a large number of new container ships.

MSC has by far the largest order book and more than double the newbuilding capacity of any other shipping company. According to the latest figures from Alphaliner, MSC has an order book of 1.73 million TEU, equivalent to 38% of its existing fleet.

COSCO's order capacity ranks second at 884,000 TEUs, followed by CMA CGM with 689,000 TEUs.

In terms of the ratio of orders to existing fleet capacity, Zim leads the way with an order book of 378,000 TEUs, equivalent to 71% of its existing fleet capacity.

Collectively, the top 10 liner operators have new ship orders of 5.5 million TEU, equivalent to 25% of the existing fleet capacity.

source from:https://www.sofreight.com/

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.

Fill in more information so that we can get in touch with you faster

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.