Ms. Lena lee

Leave a message

Ms. Lena lee

Leave a messageContainer throughput at the ports of Los Angeles and Long Beach continued to decline sharply in November and is not expected to rebound until the second quarter or even the second half of next year.

In the Port of Los Angeles, 13 sailings were canceled in November and 20 sailings were canceled in October. Shipping companies will cancel another 11 voyages in December. That number is likely to increase significantly after the Chinese New Year holiday, which begins on January 22.

"We haven't seen data like this since the beginning of the pandemic," Gene Seroka, executive director of the Port of Los Angeles, said at a news conference Wednesday.

Jeremy Nixon, CEO of shipping company ONE, said at the meeting that since October, ONE has canceled about 20% of its sailings and expects to cut its capacity by about half around the Chinese New Year on January 22, 2023.

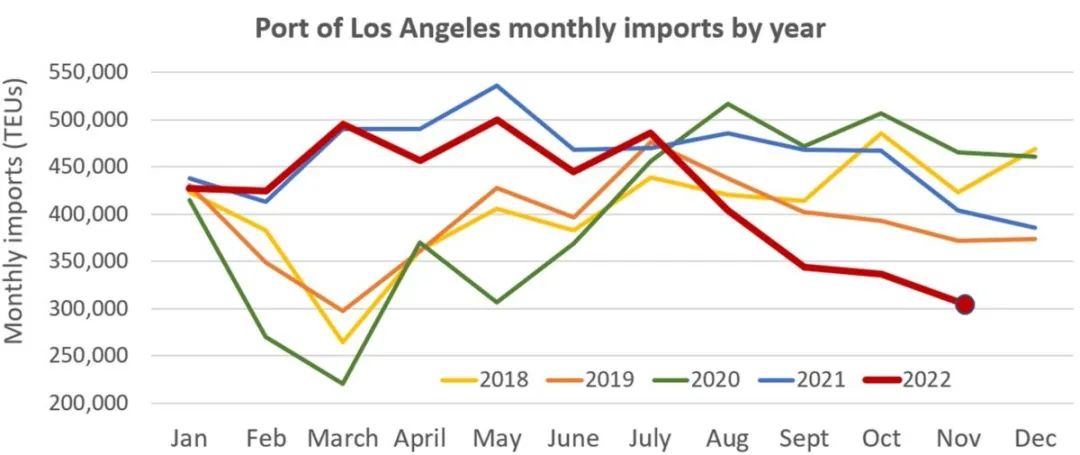

U.S. West Coast container imports continue to decline

It is reported that the Port of Los Angeles reported a total throughput of 639,000 TEU in November, down 21% year-on-year. Among them, imports fell 24% year-on-year to 307,000 TEU, down 9% from October. Imports in November this year were 17% lower than the same period in 2019. Empty container volume decreased by 26% year-on-year to 242,000 TEU, while export volume increased by 9% year-on-year to 90,000 TEU.

(Chart: Monthly import volume of Port of Los Angeles /American Shipper is based on the data sorted by Port of Los Angeles)

The Port of Los Angeles said two factors had a significant impact. One is the early peak retail import season, with retailers building up a lot of inventory; the other is protracted labor negotiations that have caused shippers and carriers to shift to other ports.

Both Seroka and Nixon pointed to the continued absence of labor contracts at West Coast ports as the main reason, with volumes heading to East Coast and Gulf Coast ports. [Once this last issue is resolved, we can hopefully see more cargo returning to the West Coast from the temporary East Coast route," Nixon said.

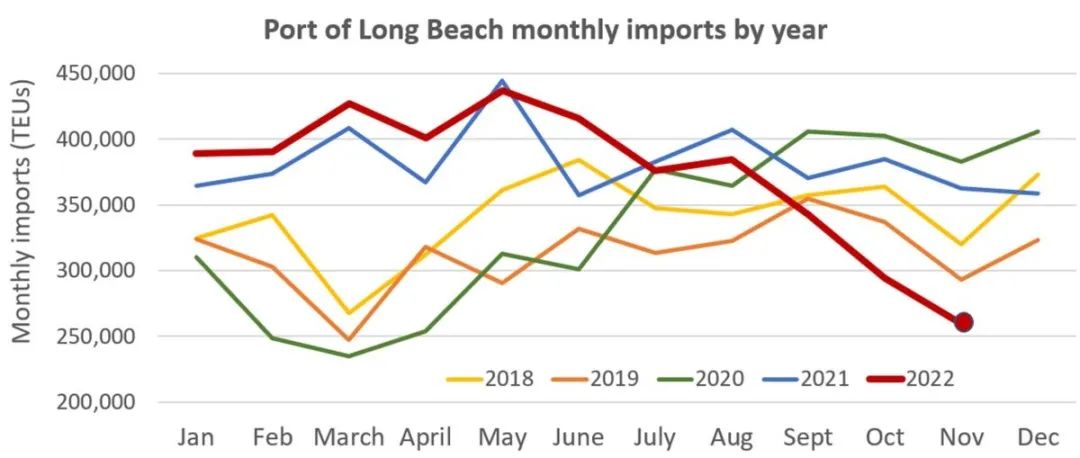

At the neighboring Port of Long Beach, container throughput in November totaled 589,000 TEUs, down 21% year-on-year. Among them, imports fell 28% year-on-year to 259,000 TEU, down 12% from October. Imports in November this year were 11.5 percent lower than the same period in 2019.

(Chart: Monthly import volume of Long Beach Port /American Shipper is based on the data organized by Long Beach Port)Regarding the continued weak cargo volume, executives at the Port of Long Beach emphasized that this is mainly due to reduced orders from retailers, full warehouses and cargo diversion to ports on the East Coast and Gulf Coast.

Mario Cordero, executive director of the Port of Long Beach, said: "While some import volume has been diverted to other gateways, we believe that a significant portion of this volume will return to the Port of Long Beach. As we move towards the normalization of the supply chain, now is the time to put our efforts A renewed focus on engaging in sustainable and transformational businesses will secure our leading position in the trans-Pacific trade lane."

No rebound until the second half of 2023?

Nixon emphasized that it expects the Chinese New Year holiday in January 2023 to have an early and long-term impact. He predicts that shipments from Asia to California will slow in February, March and April.

"Compared to last year, negative growth is expected to be 15-20 percent," Nixon forecasts. This would imply a leveling off from last year's similar level of positive growth. He said that ONE will continue to sail empty to match demand, and like most shipping companies, they may only operate 50% of their services during the Chinese New Year period, and only resume capacity when demand increases. However, he said he thinks spot freight rates may be bottoming out, which is a long-term positive for the market.

"We're getting ready for a very weak February in terms of sailings out of Asia," he said, adding that given the two-week sailing time across the Pacific, "this will show that the Port of Los Angeles is going through February and March. volumes will also be very weak."

Transpacific trade and Southern California ports are expected to return to normal by the second quarter of 2023 and beyond. However, this will depend on retailers reducing current inventory levels before resuming higher import levels.

"If we can clear the large inventory at the retail level and push it higher during the holiday sales, then we will also see some normalcy in the second quarter and beyond," Seroka said.

According to Nixon, [freight volumes will slow down in the first half of next year. But we expect that at some point, the market will rebalance. When that day comes, probably in the second half of 2023, it will return to normal."

[Traditionally, in the U.S. market, we see a quick correction. It tends to enter this situation earlier than other container shipping markets and exit sooner," Nixon said.

Nixon remains optimistic that demand will rebound next year. "Let's see how things play out, but in general, one of the things we've learned in the industry is that things go up and down. But when we have periods like this, when cargo volumes are down, that's usually Suggesting that at some point in the future, volumes will rise back above the median again. And if volumes have been low for an extended period of time, that usually means higher volumes later on."

Source:https://www.sofreight.com/

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.

Fill in more information so that we can get in touch with you faster

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.